Understanding CFD Trading: What Every Trader Should Know

Agreement for Huge difference (CFD) trading presents investors a unique

solution to deal financial markets without possessing the main asset.

It's received popularity for its freedom and possibility of high

results, but like any trading technique, it needs ability and

information to succeed. Whether you're a beginner or looking to improve

your strategy, below are a few expert methods and techniques to help you

maximize of cfds.

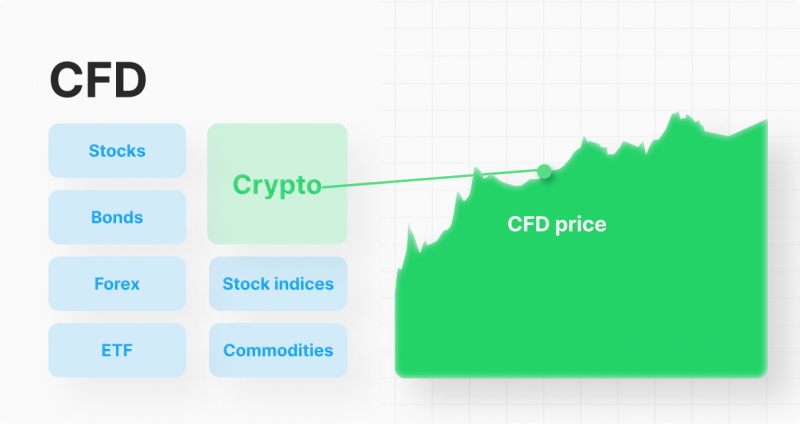

1. Realize the Fundamentals of CFD Trading

CFD

trading enables you to speculate on the cost action of assets such as

for instance stocks, commodities, forex, and indices. When you enter a

CFD industry, you are accepting to change the difference in the price

tag on an advantage between enough time you open and shut the contract.

This means you are able to benefit from equally climbing and falling

markets.

Before getting in, it's essential to really have a solid knowledge of how CFDs function, along with the associated risks. Take some time to familiarize yourself with crucial terms and ideas such as for example spread, profit, and contract sizes to help make informed trading decisions.

2. Employ Variable Leverage Wisely

One of the very desirable features of CFD trading is flexible influence, allowing traders to control bigger positions with an inferior money outlay. However, while leverage can boost gains, additionally it magnifies possible losses. Use leverage cautiously and ensure you're confident with the amount of risk it introduces in to your trading.

3. Produce a Risk Management Technique

An excellent chance administration approach is essential in CFD trading. Always set stop-loss instructions to restrict potential deficits and protect your capital. Also, define the quantity of money you are ready to risk per trade and stay glued to it. Never chance more than you are able to get rid of, as trading inherently holds some level of risk.

4. Stay Current with Market Media

CFD prices are highly inspired by industry media and global events. Staying updated on financial studies, geopolitical developments, and industry sentiment may allow you to assume price movements. Use reliable information resources and contemplate incorporating elementary analysis in to your trading strategy to make better-informed decisions.

5. Pick the Correct Markets to Business

CFD trading supplies a wide range of markets to deal, but not absolutely all areas may match your trading style. Some markets tend to be more unpredictable, offering higher potential profits but in addition greater risks. The others tend to be more stable, which may match risk-averse traders. Examine industry problems and pick the ones that arrange together with your chance threshold and strategy.

Realization

CFD trading could be a gratifying experience when approached with understanding and strategy. By understanding the basic principles, using control responsibly, managing risk, and staying knowledgeable, you can boost your odds of success. Recall, trading is just a ability that improves as time passes and knowledge, therefore be patient and continue learning as you go.

Comments

Post a Comment