Maximizing Savings Through Depreciation Deductions

When it comes to minimizing duty liabilities and maximizing economic

savings, depreciation deductions certainly are a strong instrument that

always goes underutilized. Whether you're your small business operator,

an investor, or a house owner, leveraging depreciation may considerably

affect your bottom line. This website considers how depreciation deductions function and offers methods to ensure you're completely benefiting using this crucial tax-saving strategy.

Knowledge Depreciation Deductions

Depreciation

deductions refer to the method of assigning the expense of a concrete

asset around its helpful life. Primarily, the asset's drop in price due

to use, wear and split, or obsolescence can be deducted annually from

taxable income. This approach applies to assets such as houses,

equipment, gear, and also vehicles used for organization purposes.

For

example, imagine getting equipment value $50,000 with a practical

living of 10 years. Instead of taking the full $50,000 reduction in the

initial year, depreciation regulations allow you to distribute that

price across 10 years, perhaps subtracting $5,000 annually.

By distributing out costs in this way, you lower annual taxable income, effectively reducing the taxes owed.

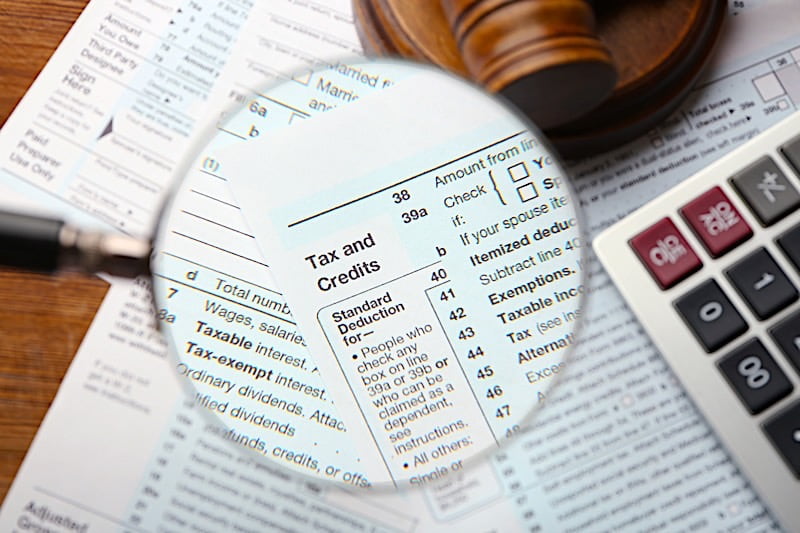

Crucial Statistics Promoting Depreciation Deductions

Numerous event studies and surveys disclose the economic benefits of depreciation deductions. For instance, IRS data show that companies in the U.S. said over $500 million in depreciation deductions in a recently available duty year. Such savings offer organizations with added resources to reinvest or cover operational expenses.

Still another noteworthy stat comes from the actual property sector. Reports suggest that home owners applying depreciation techniques save, on average, 10-15% annually on the taxable income. These figures spotlight the substantial yet often neglected possible of depreciation.

Popular Kinds of Depreciation Practices

To increase savings, it's essential to understand the various ways of calculating depreciation. Some of the most popular contain:

Straight-Line Depreciation

Here is the easiest process, where the asset's charge is separated equally over their useful life.

Decreasing Stability Strategy

This technique applies bigger deductions in the original decades of the asset's use and gradually decreases the worthiness over time.

Advantage Depreciation

Benefit depreciation allows for a bigger upfront reduction, especially helpful for firms obtaining substantial assets.

Section 179 Deduction

That provision enables immediate cost deductions for qualifying property purchases. It is particularly common among small businesses.

Ideas to Increase Depreciation

Identify Eligible Assets: Assure all depreciable assets, from structures to company machinery, are a part of your duty planning.

Consult a Qualified: Tax laws frequently modify, and a duty expert will help ensure you're leveraging every applicable deduction.

Get Advantage of Advantage Depreciation: If available, seize this opportunity for significant upfront savings.

By completely knowledge and employing depreciation deductions, companies and individuals may uncover substantial savings possibilities and position themselves for long-term economic success.

Comments

Post a Comment